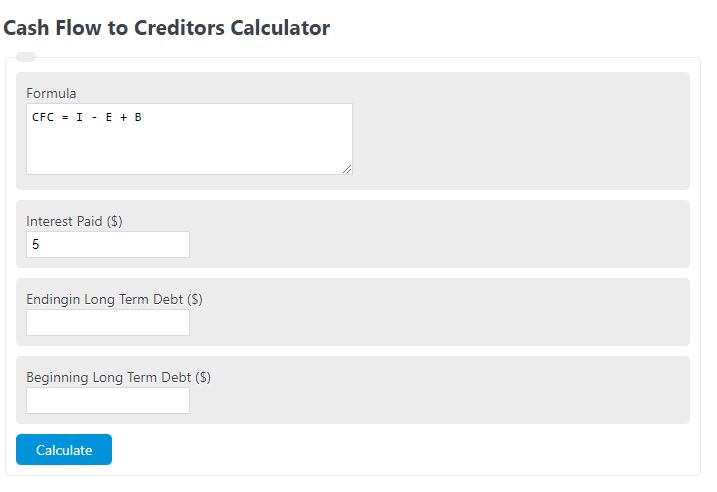

Where cfc is the cash flow to creditors. E is the total net new equity raised;

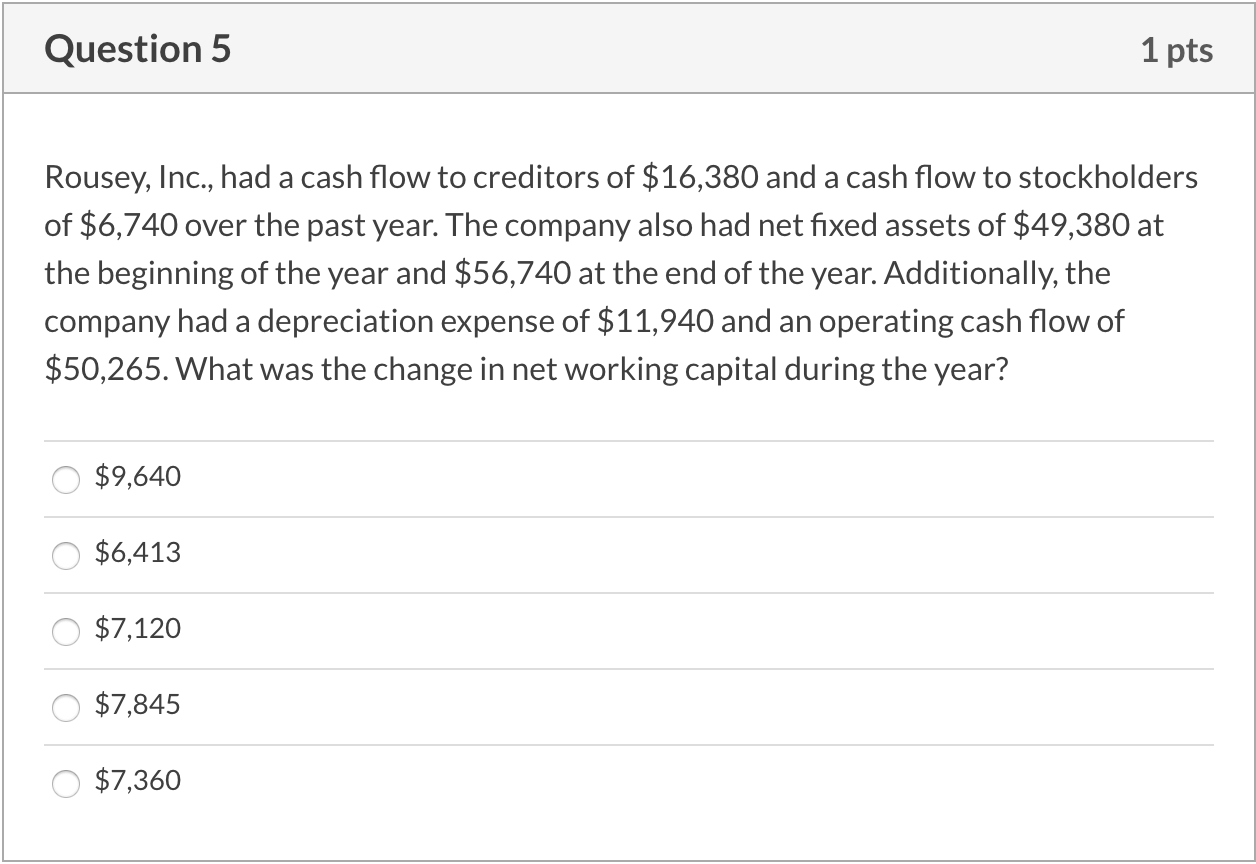

Solved Question 5 1 Pts Rousey Inc Had A Cash Flow To Cheggcom

Cash paid for salaries and wages.

Cash flow to creditors formula quizlet. A positive number indicates that cash has come into the company, which boosts its. Cash paid for other accrued expenses. As an example, assume your company made $150,000 in.

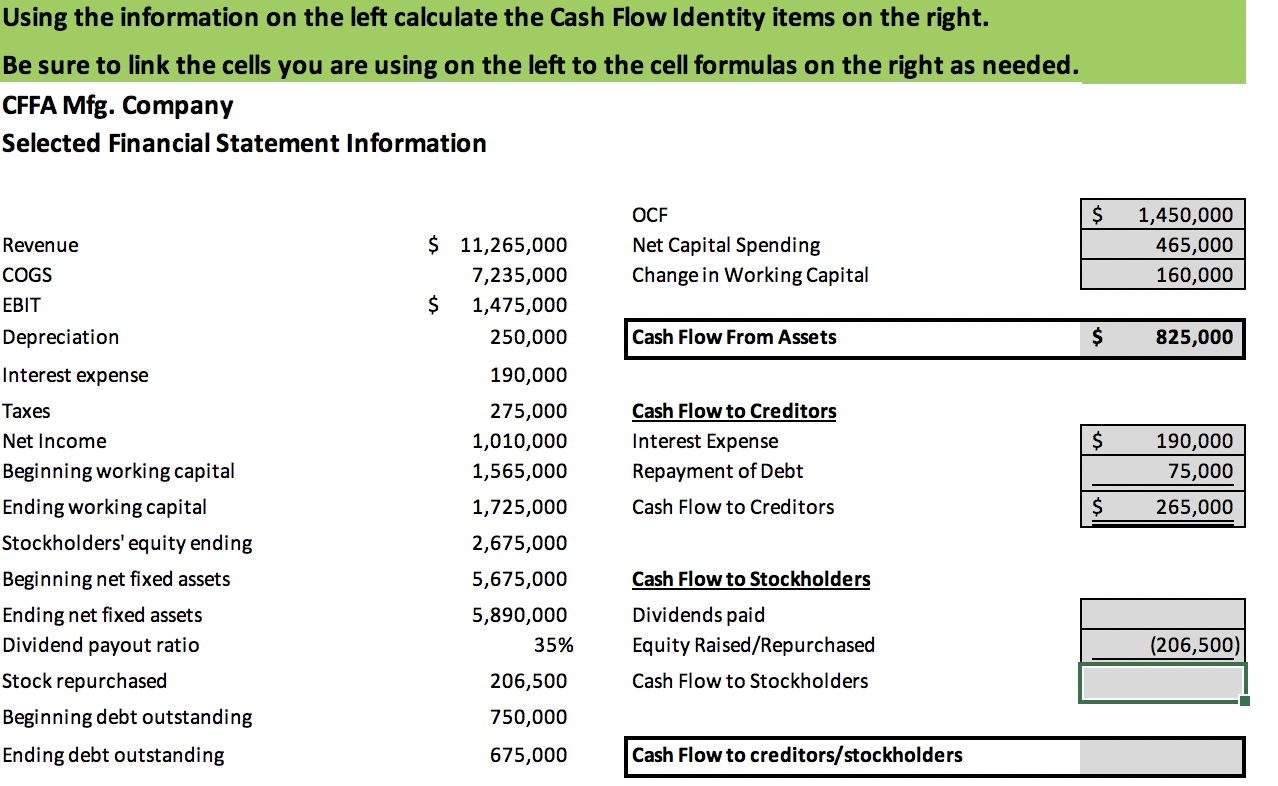

As per the information given in the 2014 income statement given, the operating cash flow is calculated as: The following equation is used to calculate the cash flow to stockholders. This results in the following cash flow from assets calculation:

The profit for 2006‐2007 was rs.8,600 against this had been charged dep. Cash flow to stockholders formula. How to calculate cash flow:

Cash flow to stockholders definition. Cash flows to creditors formula. To calculate net cash flow from assets deduct the value of operating cash flow from net capital spending and then deduct the result from changes in the net working capital.

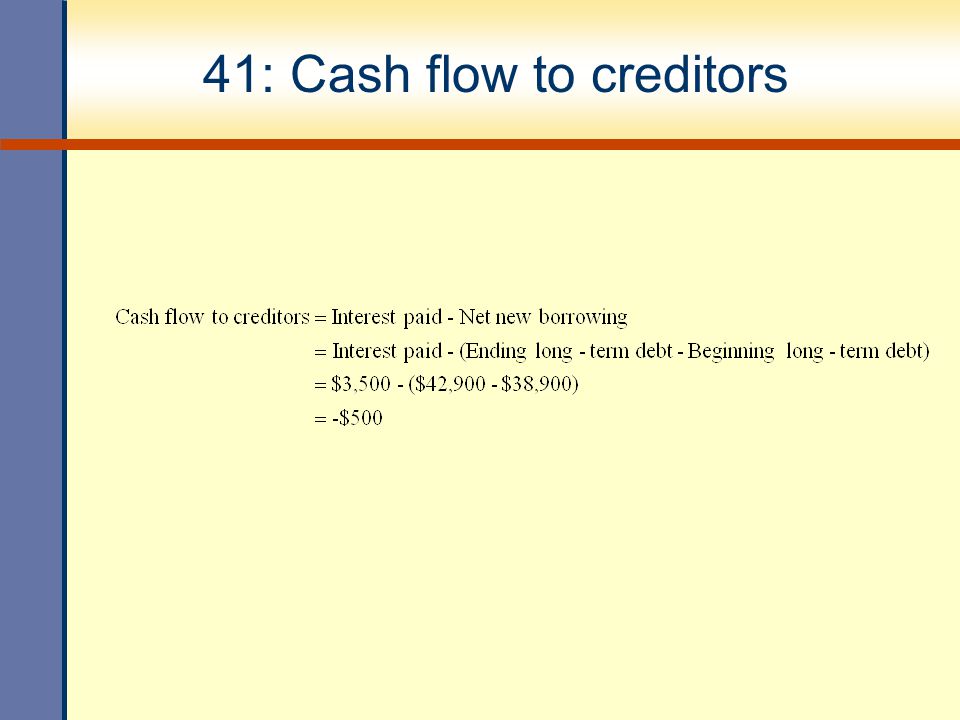

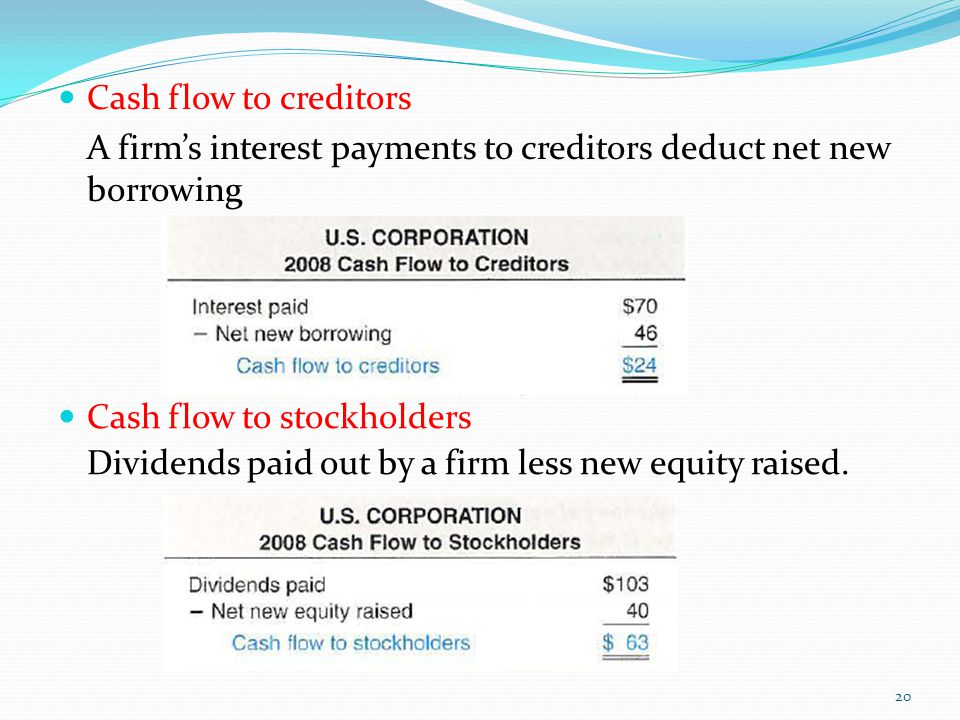

The cash flow to creditors is: The basic formula for operating cash flow is earnings before interest and taxes, or ebit, plus depreciation and minus taxes. D is the total dividends;

After taking the following information in to account, prepare a cash flow statement for the year ending 31.12.2007 1. Where cf is the cash flow to stockholders; Cash flow is the measure of total amount of liquid cash that is moving in and out of the business.

The following formula is used to calculate the cash flow to creditors. This section of the statement of cash flows measures the flow of cash between a firm and its owners and creditors. B is the beginning long term debt.

E is the ending long term debt. Below is the explanation of the components of the formula: I is the total interest paid.

The total cash flow to stockholders is the amount of cash that moves to. Inflows and outflows of cash and cash equivalents (learn more in cfi’s ultimate cash flow guide the ultimate cash flow guide (ebitda, cf, fcf, fcfe, fcff) this is the ultimate cash flow guide to understand the differences between ebitda, cash flow from operations (cf), free cash flow (fcf), unlevered free cash flow or free cash flow to firm (fcff). This is the total value that you have paid as interest on the total liabilities during an accounting period.

3,050 and increase in provision for doubtful debt rs.200 2. The same details are required for the calculations.

Solved 9a What Was The Firms Cash Flow To Creditors In Cheggcom

Acc1 14 The Statement Of Cash Flows -2 Flashcards Quizlet

Chapter 23 - Statement Of Cash Flows Mc Computational Flashcards Quizlet

Fra Cash Flow Statements Flashcards Quizlet

Solved Problem 2-23 Calculating Cash Flow Use The Following Cheggcom

Chapter 2 Financial Statements Taxes And Cash Flow Flashcards Quizlet

Chapter 2 Financial Statements And Cash Flow Flashcards Quizlet

Chp 2 - Financial Statements Cash Flow And Taxes Flashcards Quizlet

Cash Flows - Money Moves

Financial Statements Taxes And Cash Flow - Ppt Video Online Download

Solved Use The Following Information For Taco Swell Inc Cheggcom

Financial Statements Taxes And Cash Flow - Ppt Video Online Download

Chapter 2 Financial Statements Taxes And Cash Flow Flashcards Quizlet

Using The Information On The Left Calculate The Cash Cheggcom

Chapter 2 Financial Statements Taxes And Cash Flow Flashcards Quizlet

Financial Statements Cash Flows And Taxes - Ppt Download

Cash Flows - Money Moves

Cash Flow To Creditors Calculator - Calculator Academy

Cash Flows - Money Moves