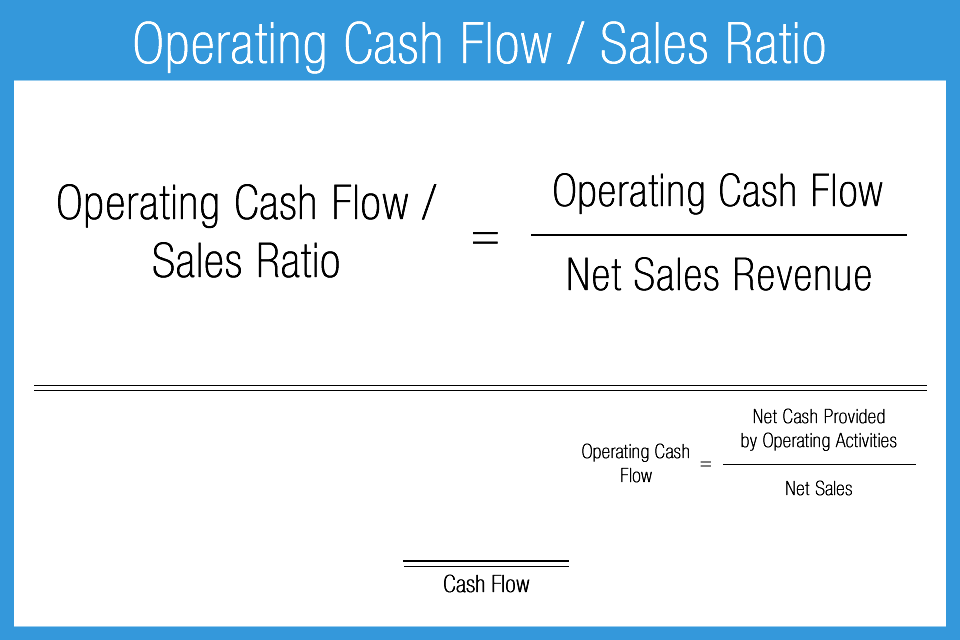

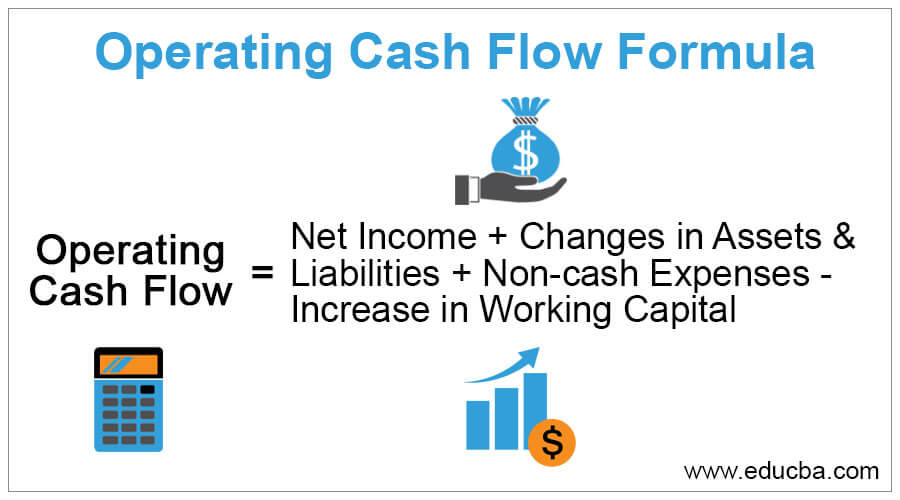

We will start by explaining that the operating cash flow refers to the real money a company makes or loses over a fiscal period. Operating ratios is the ratio which measures the efficiency of a firm's management comparison with operating expense to net sale.

Cash Flow Ratios - Accounting Play

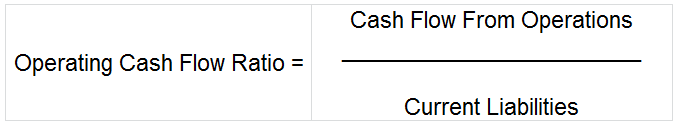

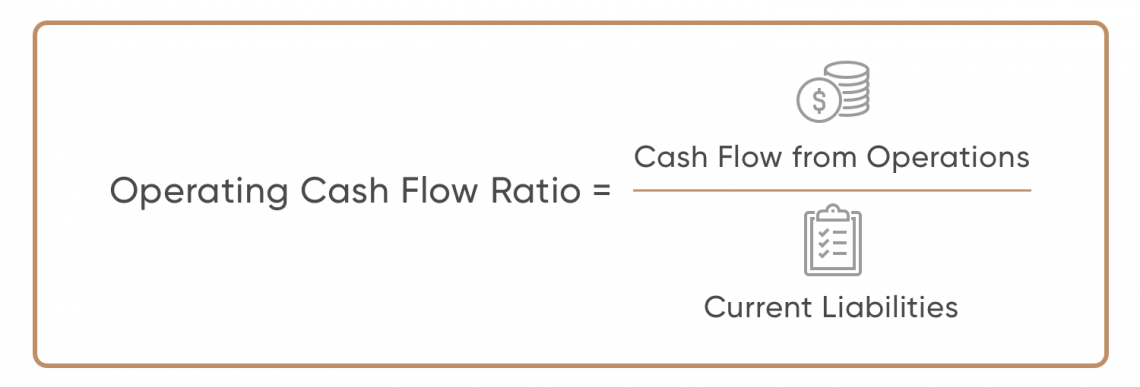

The operating cash flow to current liabilities is an alternative to the current ratio.

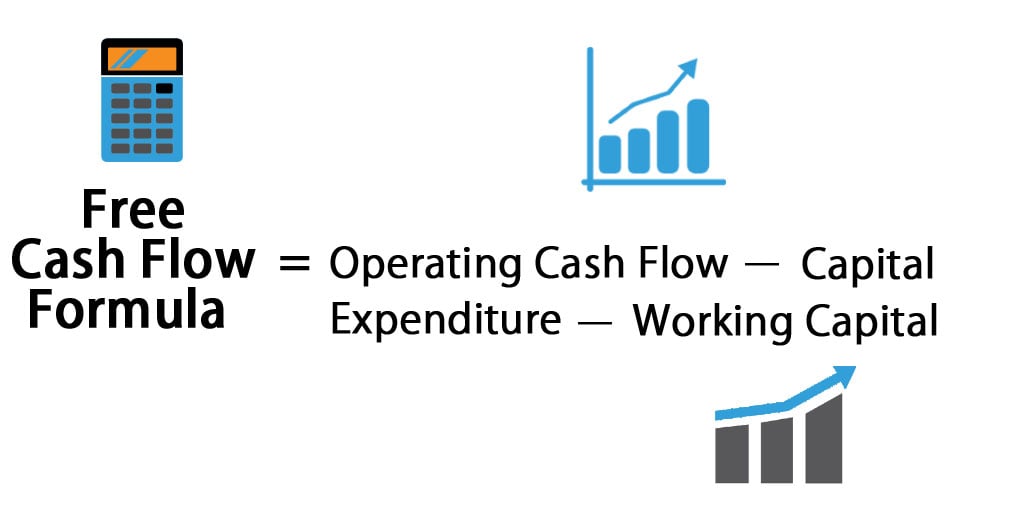

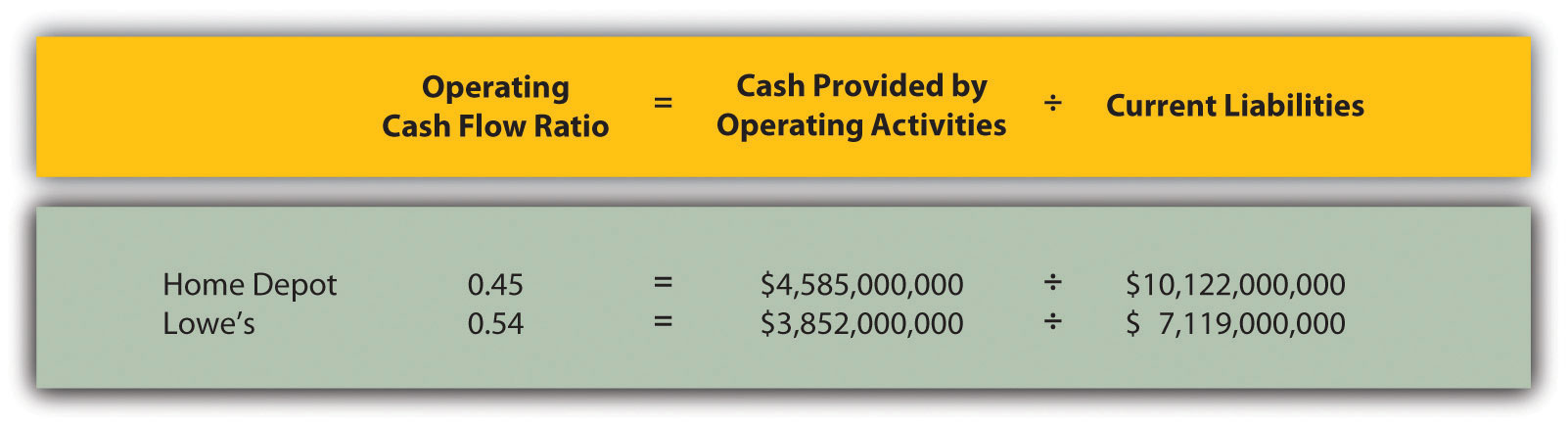

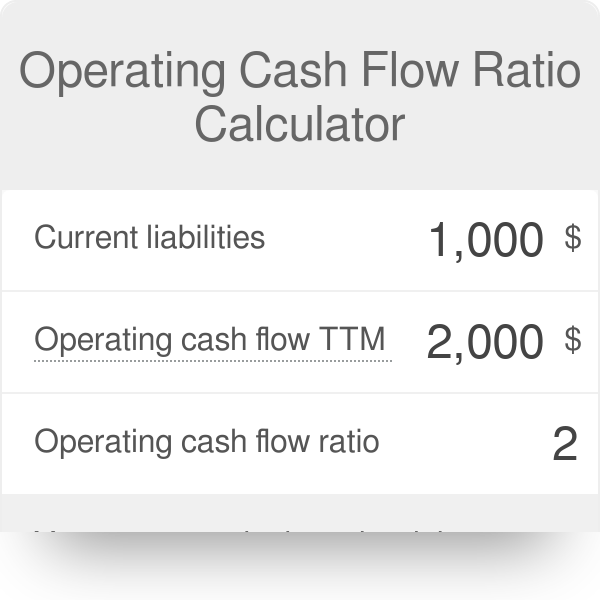

Operating cash flow ratio calculator. Operating cash flow ratio determines the number of times the current liabilities can be paid off out of net operating cash flow. Ce is the capital expenditure (capital spend) wc is the change in working capital. It is useful for measuring the cash margin that is generated by the organization's operations.

Ocf (operating cash flow) calculator; The operating cash flow ratio is a financial relationship that expresses how well the operating cash flow covers the company's current liabilities. Operating cash flow to current liabilities.

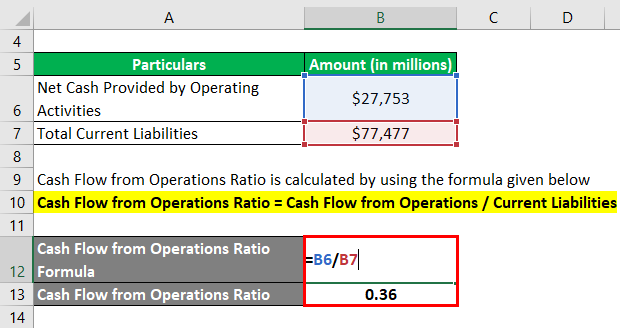

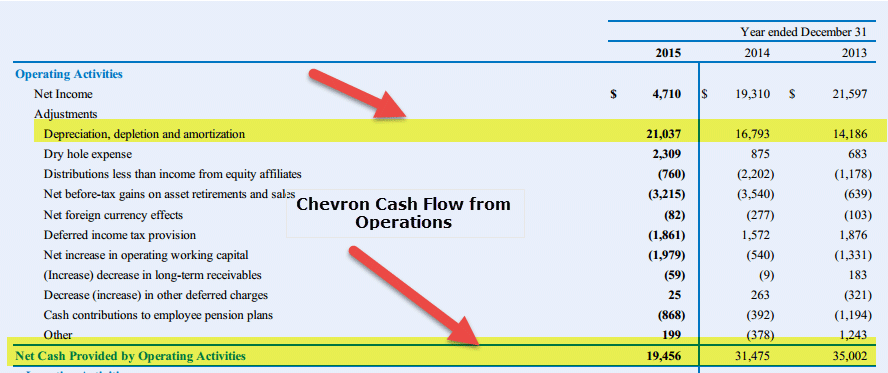

Below is an operational activity financial statement, through which we have to calculate operating cash flow. In our below operating cash flow ratio calculator, enter the operating cash flow and the current liabilities of an organization and click calculate to find the answer. Resultantly, entrepreneurs and business analysts utilise several financial metrics like operating cash flow ratio to gauge the economic health and viability of businesses.

Target’s operating cash flow ratio works out to 0.34, or $6 billion divided by $17.6 billion. It is also known to be more precise than the net income, ebit, or even ebitda because it not only includes extra cash. Operating cash flow margin = operating cash flow / sales.

The operating cash flow ratio, a liquidity ratio, is a measure of how well a company can pay off its current liabilities with the cash flow generated from its core business operations. Traditional accounting ratios are often based on the net income of a business. In this formula, “cash flow from operations” refers to the amount of money your business generates from ongoing business activities.

The current ratio is a measure of currents assets to current liabilities, but this alternative uses a direct measure of cash inflows from the ordinary course of business. Enter the operating expense and net sales in the below online operating ratio calculator and then click calculate. The calculator will evaluate and display the free cash flow.

We can apply the values to our variables and calculate cash flow to sales ratio. The following equation can be used to calculate the cash flow from the assets of a business. Cash flow from assets formula.

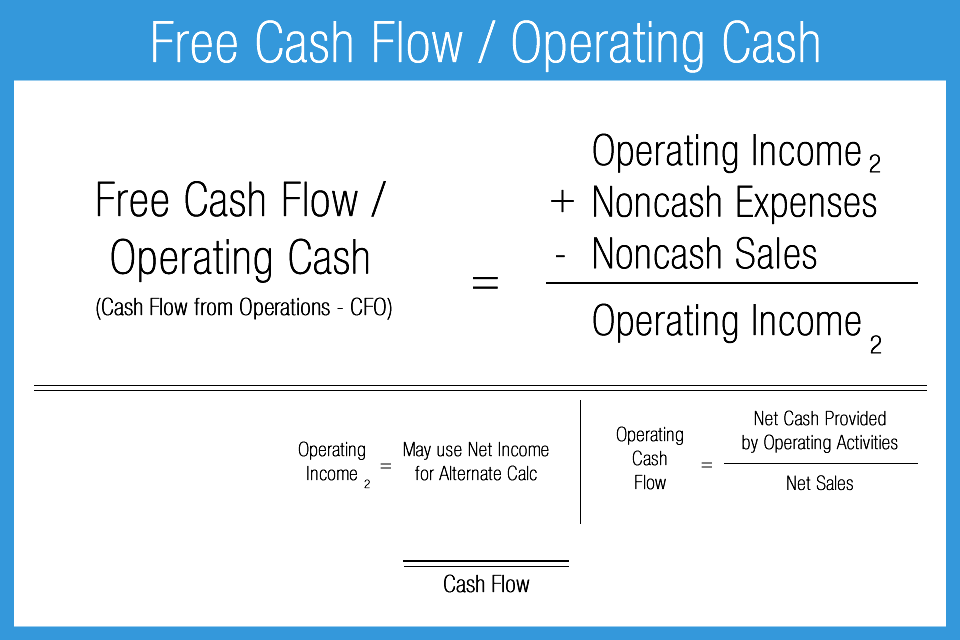

In this case, whimwick studios would have a cash flow to sales ratio of 35% for 2019. The cash flow from operations to sales ratio reveals the percentage of a company's total sales that is available for investing and financing the company's ongoing operations. Ratio analysis of a firm’s financial input and output serves as a useful measure to assess its performance and profitability.

This calculator will compute a company's cash flow from operations (cfo) to sales ratio, given the company's cash flow from operations and its total sales. This financial metric shows how much a company earns from its operating activities, per dollar of current. F is the operating cash flow.

Operating cash flow is an alternative objective measure of performance, and this cash flow ratios calculator can be used to calculate three operating cash flow ratios. To compute the ocf margin, you simply divide a company’s operating cash flow by its sales. Cash flow from operations ÷ net income = operating cash flow ratio.

Where ca is the cash flow from assets. Operating cash flow (ocf) is a common financial measure to determine whether the company is able to achieve the required cash flow to grow its operations. Comparatively large values of this ratio reflect positively on a.

Ocf 2016 = $ 10,813. Operating cash flow ratio = cash flow from operations / current liabilities. The cash flows from ancillary activities are excluded from this calculation.

The equation for operating cash flow margin is as follows: Operating cash flow and sales can be found on the statement of cash flows and the income statement, respectively. This financial metric shows how much a company earns from its operating activities, per dollar of current liabilities.

Operating cash flow ratio can be explained as the cash from operational work flow of an organization as the percentage of current liabilities for given amount of time. Operating cash flow ratio operating cash flow ratio the operating cash flow ratio, a liquidity ratio, is a measure of how well a company can pay off its current liabilities with the cash flow generated from its core business operations. Operating cash flow ratio measures the adequacy of a company’s cash generated from operating activities to pay its current liabilities.it is calculated by dividing the cash flow from operations by the company’s current liabilities.

The operating cash flow ratio for walmart is 0.36, or $27.8 billion divided by $77.5 billion. The following equation can be used to calculate the free cash flow of a business. Net income is a subjective measure which can be manipulated by accounting assumptions and opinions.

We can calculate operating ratio with the help of this below formula:

What Is Operating Cash Flow Ratio - Accountingcapital

The 10 Cash Flow Ratios Every Investor Should Know

Cash Flow From Operations Ratio Top 3 Examples Of Cfo Ratio

Free Cash Flow Formula Calculator Excel Template

Cash Flow Ratios Calculator Double Entry Bookkeeping

Understanding The Operating Cash Flow To Sales Ratio Aimcfo

What Is Operating Cash Flow Ratio - Accountingcapital

Analyzing Cash Flow Information

Operating Cash Flow Ratio Calculator

Fcf Formula - Formula For Free Cash Flow Examples And Guide

Operating Cash To Total Cash Ratio With Example - Corporate Finance Institute

Cash Flow Ratio Analysis Double Entry Bookkeeping

Operating Cash Flow Formula Examples With Excel Template Calculator

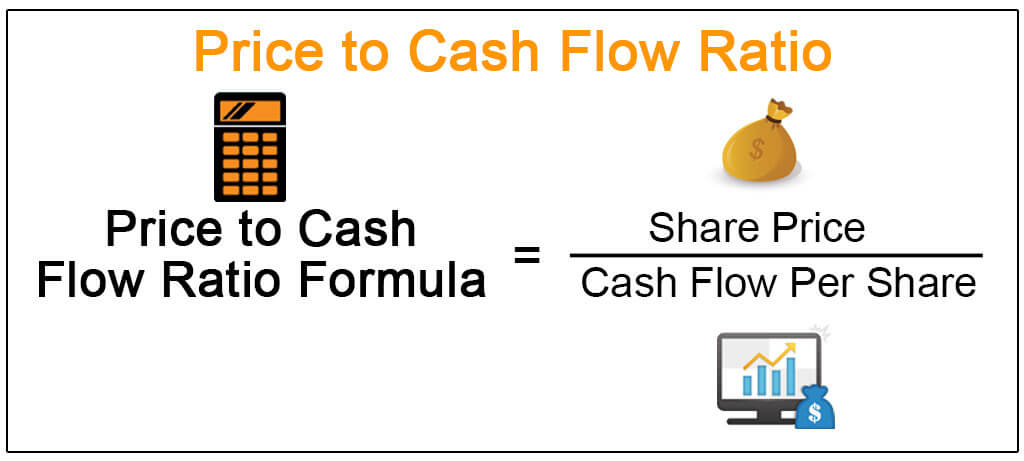

Price To Cash Flow Formula Example Calculate Pcf Ratio

Cash Flow From Operations Ratio - The Data Group

Free Cash Flow To Operating Cash Flow Ratio

Price To Cash Flow Formula Example Calculate Pcf Ratio

Operating Cash Flow Ratio Definition And Meaning Capitalcom

Accounting Ratios Basics Archives Double Entry Bookkeeping